Oh well.

Category: Internet (Page 27 of 40)

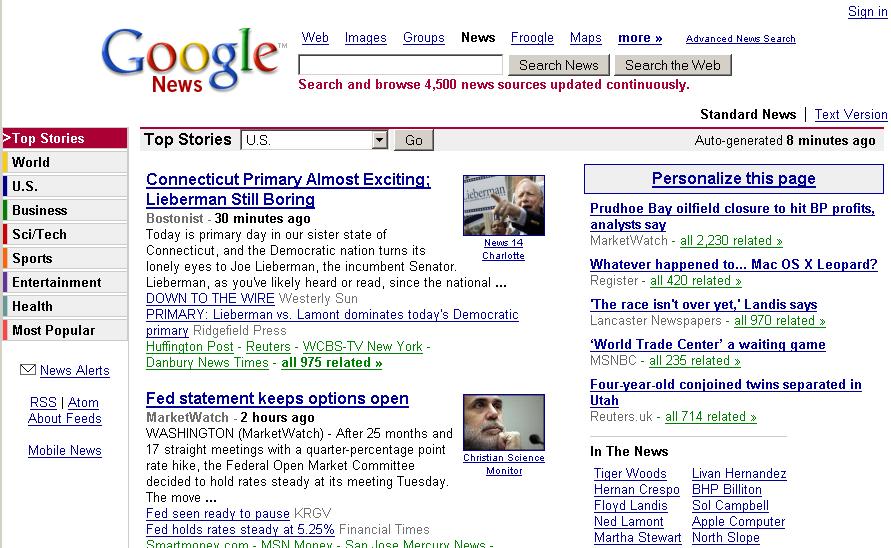

We, the devout users of Google, are supposed to believe that Google News’ superior algorithms and programming make the use of editors obsolete. But Google News has an incredibly varied—and loose—list of news sources that includes the Gothamist newblogs among them.

We, the devout users of Google, are supposed to believe that Google News’ superior algorithms and programming make the use of editors obsolete. But Google News has an incredibly varied—and loose—list of news sources that includes the Gothamist newblogs among them.

Gothamist, of course, is a blog of summary and feature, not news, at least not often. More importantly, its editors are not afraid of a good joke or bit of snark. Which is usually good for Gothamist and its readers.

But really: is it good for Google News to select as its lead election story a post from Bostonist with the headline, “Connecticut Primary Almost Exciting; Lieberman Still Boring?”

Grant Barrett nails it in his assessment of the New York Times’s redesign, in which one major decision was to bust the screen width to 1000 pixels: “Hey, who said we read (or want to read) ANY web site with the browser window filling the whole screen? The only people I know who do that are n00b Windows users.”

Mind you, the Times is simply keeping up with the joneses. Many of its peers, from the Washington Post to the forward-thinking and usability-centric Cnet to the wise folks at The Economist, have expanded their screen sizes, largely to capitalize on ad revenue and space above the fold. (Full disclosure: I commended The Economist on its redesign in this space last fall, albeit with the same point I’m about to make.)

But I’m with Grant on this one. Thanks to years of Mac use, my browser windows are never set to full-size, even when I’m on Windows. Reading studies for years have said 450 pixels is the maximum optimal width for reading text, even if some people train themselves to do otherwise. Most importantly, between 25 and 30 percent of Internet users are still on 800×600 monitors, a significant audience segment.

Yet the push for real estate nudges design ever wider, regardless of the consequences—and, perhaps, the realization that a quarter of the viewing audience won’t even see the right-hand side of the screen.

My department at work just finished an audit of two dozen ecommerce websites in our competitive space. Of them, 23 had fixed-width designs between 700 and 800 pixels. The one with full-screen capability stretched its header and footer without altering the content-and-commerce area. Clearly, the optimal usability level is not yet at 1024 pixels in width.

Colleagues at magazine websites have told me their wide-screen ad space performs well, so I won’t argue against it. But I won’t argue for it, either.

My favorite new Internet read is economists’ blogs. Short-term, off-the-cuff analysis of current events and trends by people whose discipline is to do just that. Often, economics articles come in conjunction with other editorial features; economist blogs give me lots of present-tense economic theory without waiting for a particular contextual frame.

Some of the blogs I’m reading:

The Sports Economist (particularly entertaining)

Today marks the public debut of my new weblog: Retail Media, a discussion of the increasing efforts by consumer-goods retailers to harness the power of the media. The blog is off to a juicy start thanks to Nordstrom Silverscreen and Saks’ new children’s book (read more). Retail Media will be updated regularly as retailers and brands make continued forays into publishing, broadcasting and interactive content. See you there.

Once upon a time Blow the Dot Out Your Ass was a wonderfully timely meme. Stickers slapped all over San Francisco decried the endless progression of Internet omniscience and gave most of us in the industry a good laugh.

Fast forward to 2005: the “anti-dot-com” domain blowthedotoutyourass.com has been commandeered by a porn site. Perfect. (And oh, the wordplay.)

I’m looking at resumes for web designers today (see also), and on three occasions I’ve had my browser window forced to a “full-screen” size that extends so far that I can’t find the bottom right corner to resize it.

Memo to designers (including, I will admit, my own coworkers in France): resizing browsers to unwieldy screen sizes does nothing to improve the performance or likability of your designs. All it does is aggravate the end user—in this case, the hiring manager—and greatly reduce the probability that the user will ever return to the site.

You’d think that in 2005 we’d all know this.

In this delightful mid-decade era of dotcom revivalismâVC money! hot tech stocks! freelancing!âcomes Max Delivery, a new service for downtown Manhattan. Get DVDs and toothpaste delivered to your door an hour! I’m guessing the ridiculous perks of Kozmo and Urbanfetch (movie pickup, no tipping, free T-shirts) no longer apply, but with built-in delivery fees and New Yorkers’ demanding style, this business model could rise once again.

Back in March I popped into del.icio.us the stock charts of 10 listings that were sent to me via email spam. I was curious whether the blind feeds led to any quick ramp-up, in days or weeks, via speculation or otherwise. Hit “read more” for the results.

Back in March I popped into del.icio.us the stock charts of 10 listings that were sent to me via email spam. I was curious whether the blind feeds led to any quick ramp-up, in days or weeks, via speculation or otherwise.

First up was Martin Neutraceutical (MTNU.PK), which arrived in an email dated 2/23. On February 23rd, the stock traded at around $1; it popped up a few cents around the 24th, then began a long and steady decline. It is now trading at $0.14.

Yukon Gold Corporation (YGDC.OB) only trades once or twice a day, according to the daily chart and volume totals. First noticed March 8, the stock has basically flatlined since then, and trades at $1, off from $1.10-1.20 in March.

Humatech Inc (HUMT.OB) went for around 10 cents on March 9. It peaked there and is 7 cents today. Not bad, as long as you only own 100 shares.

OSSI.PK no longer trades; it is now TSAS.PK and only has a 5-day chart. So much for that.

On March 10 I was urged to buy Sivalt Systems (SVTL.OB) at just under $2 a share. What a missed opportunity: the stock never broke $2 and is down to $1.35 today.

Well, four to go, or three, rather—KSIG.OB is now KSIGE.OB. I can’t follow the trend, but it’s at 6 cents, so that’s not a good sign.

Anywhere MD (ANWM.PK), unlike the other stocks on this list, actually has news items and a six-month chart. What it doesn’t have is performance: The stock had dropped from $0.20 to $0.10 before the email spam and never recovered, trading at $0.05 today after a brief spike down to almost $0.

The charts of Yap International (YPIL.PK) and DSI Direct Sales (DSDI.P) look like the other ones above: on the decline before the spam, no different after. Both have a value half of that when the spam first hit my in-box.

That’s nine in a row gone sour. Stock spam seems to operate on the “even a broken clock is right twice a day” theory, though, because my inventory review did uncover a winner.

Gaming Transactions (GGTS.PK) came to me on March 12 with a forecast in the email of “near term target 0.45, long term target 1.00.” Nice estimating: from a price around 30 cents in mid-March, the stock burst past $0.50 in early April and is trading at $0.74 after peaking at $0.90. An investment in this stock would have nearly tripled in value in three months, a pretty good return on some junk mail.

I’m not a financial analyst, so I won’t get into the specifics of ROI for my experiment. The findings are clear, though: you too can have a winner playing stocks in spam messages—you’ll just have a lot of losers along the way.

I read Ask Metafilter twice daily. I contribute far less frequently, and I skip a lot of threads—the site has too many discussions about computer problems and places to drink in New York City—but the sheer breadth of questions is fantastic, especially now that the site has re-introduced anonymous asking.

A sampling from the past 24 hours alone:

God found my wife, now what do I do?

Is there a reason why I pee more when I stay up all night working?

I want to cultivate some good mental exercising habits.

With this level of diversity and sheer randomness, it’s a must-visit.

I’m also an Ask Metafilter user. Here are the questions I’ve asked over the years, which I think are a pretty good introduction to the site on their own.